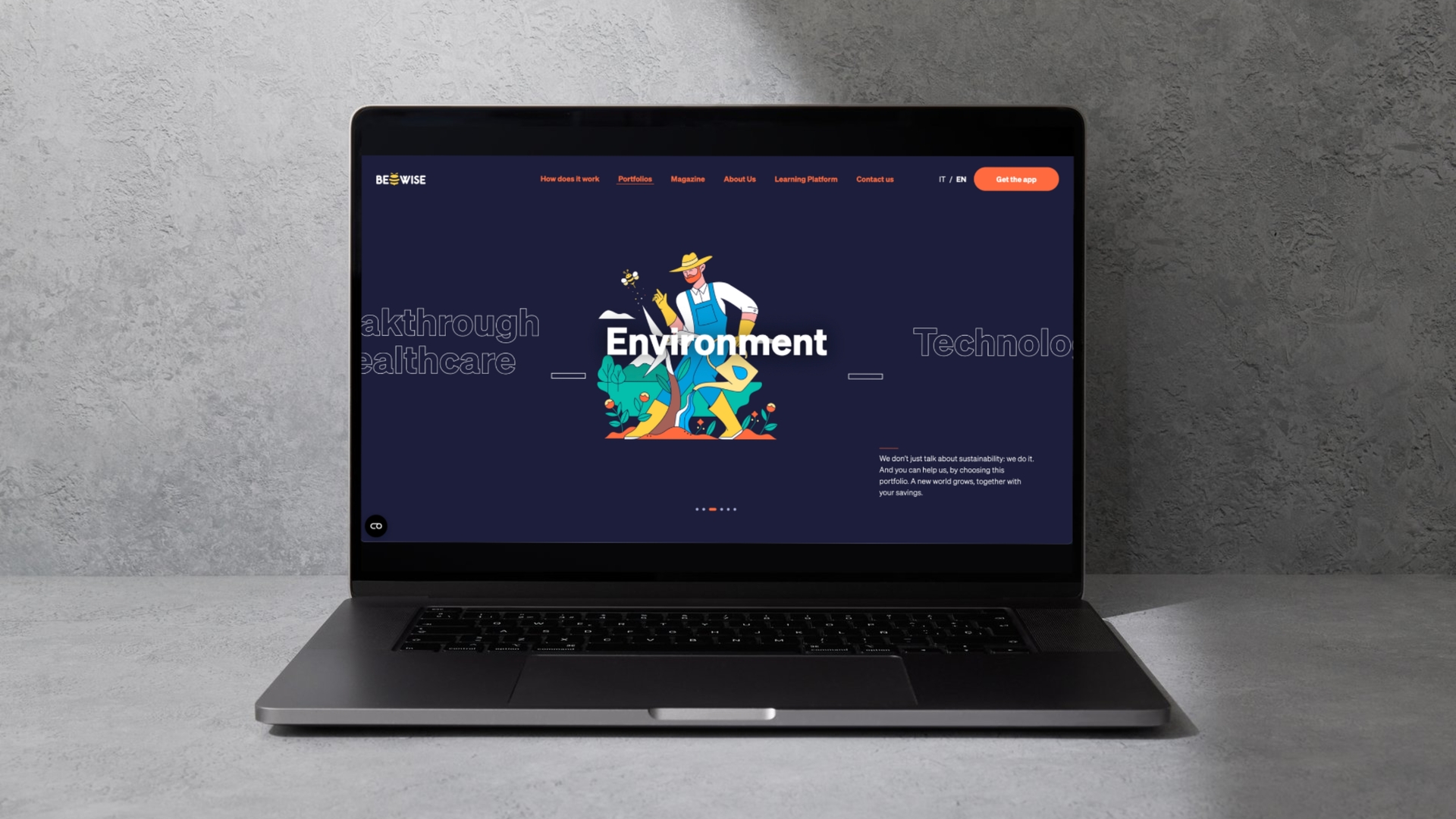

Investing with Purpose: Explore Beewise’s Thematic Portfolios

Discover the 6 thematic Beewise portfolios.

The Beewise investment app was launched in Italy in 2022. Since our launch, one of our most intriguing features is our array of thematic investment portfolios. These portfolios allow investors to align their financial goals with their personal values and interests, offering a unique and meaningful investment experience. This article delves into the details of these thematic portfolios, examining their structure, purpose, and how they cater to the modern investor’s desire for value-driven investment opportunities.

The Essence of Thematic Investment Portfolios

Beewise’s thematic investment portfolios are designed around specific themes or sectors that are not only financially promising but also resonate with the personal beliefs and interests of investors. These themes include Technology, Environment, Future Generations, Breakthrough Healthcare, and Smart Cities, and Cash Plus. Each portfolio is curated to reflect the dynamics and potential growth of its respective theme, offering investors a way to contribute to sectors they are passionate about while seeking financial returns. So without further ado, let’s dive into our 6 portfolios:

1. Technology portfolio

We live in a tech-driven world where AI, fintech, and cybersecurity are transforming everything around us. Investing in our Technology portfolio means backing companies that are shaping the future. With AI automating industries, and fintech revolutionizing how we handle money, this portfolio offers a forward-looking approach to growth. It’s perfect for investors who believe in tech as the key to solving real-world problems.

2. Environment portfolio

Our Environment portfolio lets you put your money where your values are. Focused on green energy, sustainable agriculture, and climate-friendly innovations, this portfolio offers a chance to invest in companies that are actively contributing to a better planet. It’s a win-win: financial growth while helping create a sustainable future.

3. Future Generations portfolio

Emerging markets are no longer just a buzzword—they’re home to some of the world’s most exciting growth stories. Our Future Generations portfolio taps into these economies, where young populations and evolving consumer habits are driving innovation. By investing in this portfolio, you’re not only looking at today’s opportunities but the next generation of economic growth.

4. Breakthrough Healthcare portfolio

The healthcare sector has seen transformative innovations in recent years—gene therapy, AI diagnostics, and telemedicine are just a few examples. With our Healthcare portfolio, you’re investing in companies that are pushing boundaries to improve lives. It’s a sector that’s resilient and essential, offering not just profits but a way to make a positive impact on society.

5. Smart Cities portfolio

As the world’s population becomes increasingly urbanized, smart cities are leading the way in solving the challenges of modern urban life. From sustainable infrastructure to digital services, our Smart Cities portfolio invests in companies that are shaping cities of the future. Think of it as investing in the urban revolution—from smarter transport systems to better resource management.

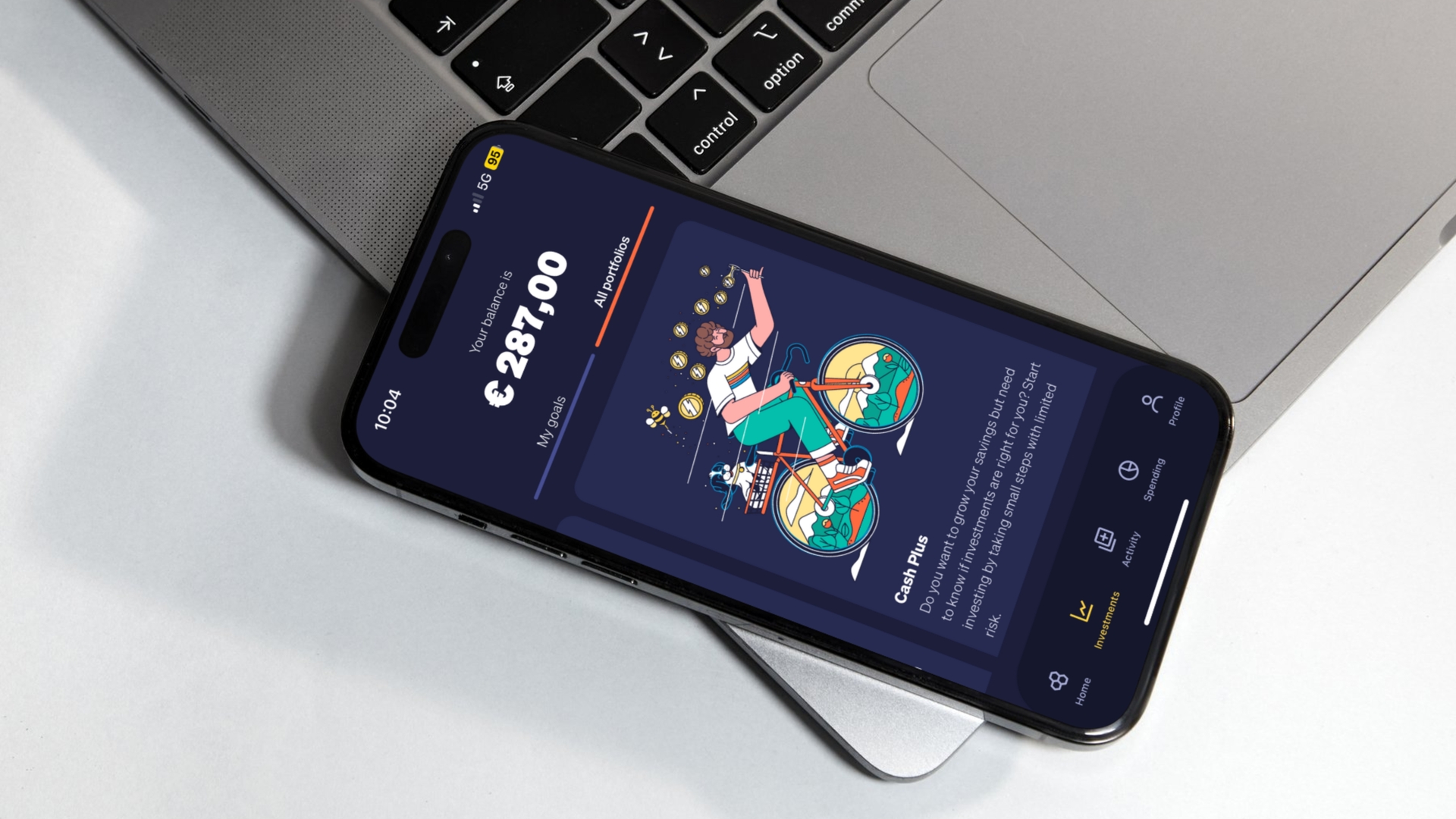

6. Cash Plus portfolio

Our Cash Plus portfolios are short maturity bond portfolios offering a low-risk, stable investment option for cautious investors seeking modest returns with minimal volatility. These portfolios invest in short-term debt instruments, providing a safe alternative to equity investments or idle cash, and are ideal for those with a short-term horizon of 3 to 12 months. They offer liquidity, protection against inflation, and can serve as a transitional strategy into more aggressive investments like thematic equity portfolios. With consistent returns and reduced exposure to market swings, short maturity bond portfolios can be a reliable addition to a diversified portfolio, especially for those prioritizing capital preservation.

Managed by the Global Azimut Team

A standout feature of these portfolios is their management by the global Azimut team, which brings over 30 years of investment expertise to the table. This professional oversight ensures that each portfolio is strategically balanced and optimized for performance, making these investment options accessible to both novice and experienced investors.

Integration with ESG Criteria

All our thematic portfolios, excluding our latest Cash Plus portfolio, are integrated with Environmental, Social, and Governance (ESG) criteria. This integration ensures that the investments are not only financially sound but also ethically and socially responsible. For investors concerned about the impact of their investments, this feature provides peace of mind and aligns with their values.

Low Entry Threshold

Reflecting Beewise’s commitment to inclusivity in investment, these thematic portfolios have a low entry threshold, allowing individuals to start investing with as little as 10 euros. This democratizes access to investment opportunities that were traditionally reserved for investors with significant capital.

Contribution to Reforestation Projects

In line with its ethos of responsible and value-driven investing, Beewise also offers investors the option to contribute to global sustainability efforts. Through a partnership with WeForest, investors can choose to donate 1% of their investments to reforestation projects, further extending the impact of their investment beyond financial returns.

Beewise’s thematic investment portfolios represent a paradigm shift in the world of personal finance and investment. They offer investors an opportunity not just to grow their wealth but to do so in a way that aligns with their personal values and interests. The combination of professional management, ESG integration, accessible investment thresholds, and a focus on impactful themes makes these portfolios a compelling choice for modern investors. Beewise, through these portfolios, isn’t just offering investment options; it’s providing a platform for investors to be a part of themes and causes they believe in, marking a new era in personalized, value-driven investing.

Ready to align your investments with your values? Start investing with Beewise today!

Disclaimer: This article has been distributed for educational purposes only and should not be considered investment advice or a recommendation of any particular security, strategy, or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.