4 ways to save money better than you ever did before

A short guide to help you save better.

Nowadays personal finances have become a more prevailing topic than ever before, and with good reason. We are increasingly looking for ways to manage and control our personal finances better. The more you are aware of your financial situation, the easier it becomes to slowly but continuously improve it. As saving often tends to be associated with retirement, this might be seen as something that you only need to start doing at a certain point in your life. However, this is a big misconception. The earlier you start, the better. Even though saving essentially provides more financial security in case unexpected events occur, it can also be seen as a way to help you achieve your dreams, small or big, and find new opportunities for growth. Bit by bit you can start building the life you have always dreamed of, as long as you have the right mindset, a clear goal, and a plan. So how can you save better? The key to saving is finding the most effective ways to spend less. Even though this might be different for everyone, there are some common ways to get the ball rolling.

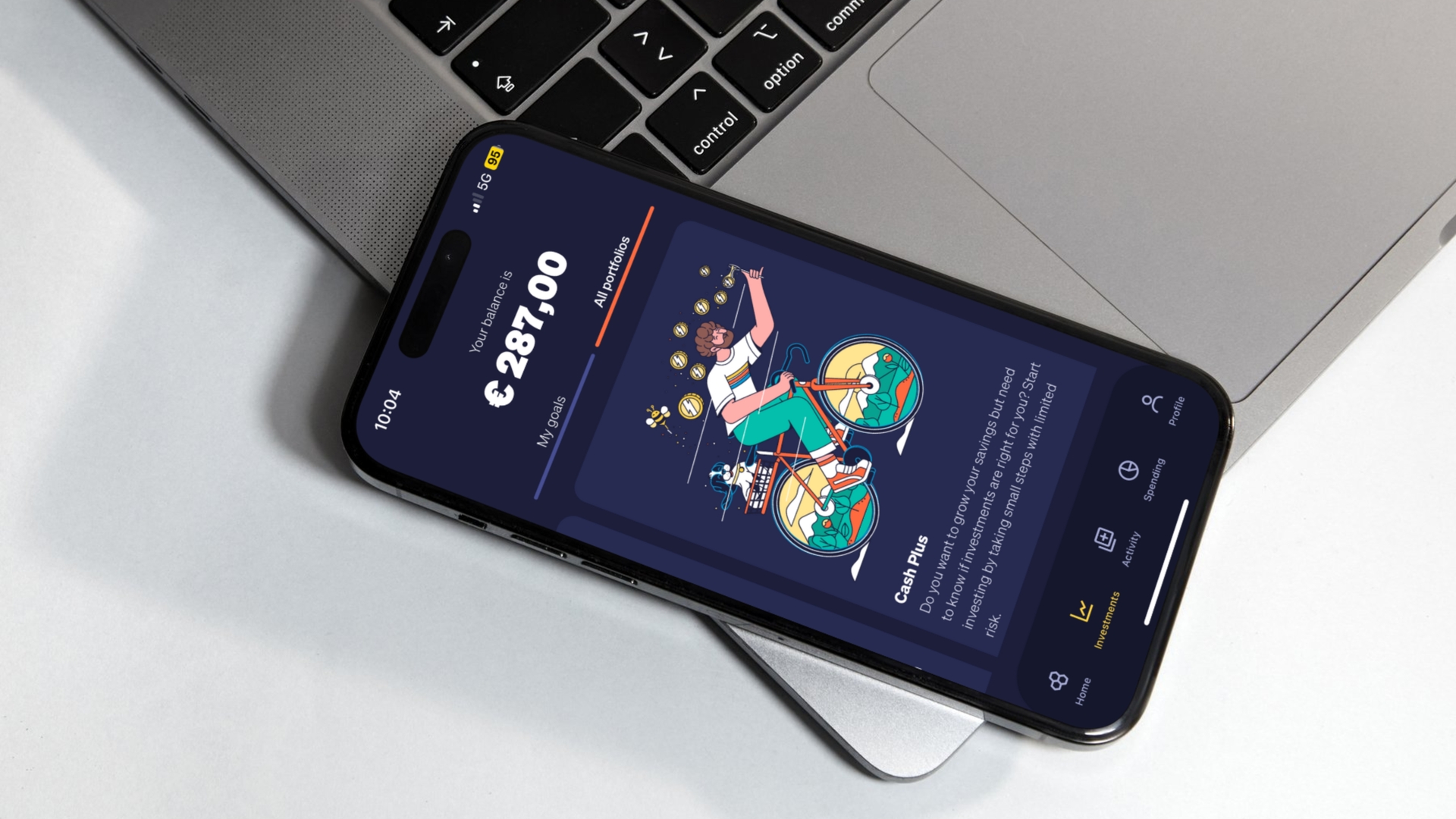

1. Use the right tools

To start saving you need to use the right tools. If you have not yet, opening a savings account is a great first step to saving. Setting up automations, like a monthly recurring transfer to your savings account will allow you to set aside the same amount of money each month without having to be reminded of it. Ideally, you should try to save a minimum of 10 to 20% of your income each month. For the remaining income that you can spend, you should try to set up monthly budgets for different spending categories. Having a clear view of your spendings, and comparing it to previous months can reveal how you can improve your spendings. Many apps can help you set up budgets and keep track of your spendings to see if you are staying within that budget.

2. Spend less for the same

Have you ever thought about how many purchases you make without comparing them to other similar products on the market? If you haven’t yet, you will be surprised what difference some research could do. Often you can find very similar products at a considerably low price once you start analyzing and comparing your options. Start by focusing on significant recurring spendings, such as your insurance or mobile provider, and trying to find better options. Other ways to spend less for the same could be through buying quality products from less known brands, second-hand, DIY, or discounted products. Buying significant purchases during sales periods can also definitely be worth it. For purchases throughout the year, we recommend using money-saving browser plug-ins such as Honey, Amazon Assistant or Rakuten.

3. Eliminate unnecessary spendings

Often many unnecessary spendings can easily be eliminated by spending some time evaluating your personal finances. To prevent yourself from buying unnecessary items, a simple trick that tends to work well is calculating your purchase by work hours. This will help you get a better perspective and will help you make rational decisions. On top of that, you could use the 30-day rule. This means each time you are not 100% sure you need it you should wait and reconsider that purchase for the next 30 days. You will see you’ll most likely end up not making the purchase. Another effective way to save more is eliminating recurring spendings that are not used very often, such as subscriptions and memberships. You should also dig a bit deeper into your daily spending habits and realize which other small recurring purchases, such as coffee, you could easily eliminate.

4. Hop on the sharing train

Even though public transportation and carpooling can be great alternatives to owning a car, there clearly is a car-sharing trend that many are starting to follow. Having the comfort of using a car when you need it while eliminating the costs that come with owning a car is a very attractive solution that caused many to rethink whether they need to buy a car. Besides car sharing, there are also other great sharing platforms that allow you to exchange or lend/borrow products or services within your community. These platforms not only allow us to reduce our spendings but at the same time try to help out our planet a bit.

Want to learn how to manage your personal finances better? Read our next article about budgeting – the fast track to savings.